Pricing

How We Are Paid for Service

We’re a fee-only firm, which means we’re compensated directly by our clients — never by commissions or product sales. And we are an independent advisor, which means no sales quotas to meet. We take clients who are a great fit for both themselves and ourselves. Our goal is simple: to provide advice that’s always in your best interest.

Currently, your fees are based on the assets that we manage and are usually 1% or less of the total. Fees can be paid directly or through invested accounts. Your fees are deducted quarterly from your investment account and can always be found in your quarterly report located within your Private Client Portal.

Ongoing Financial Planning & Investment Management

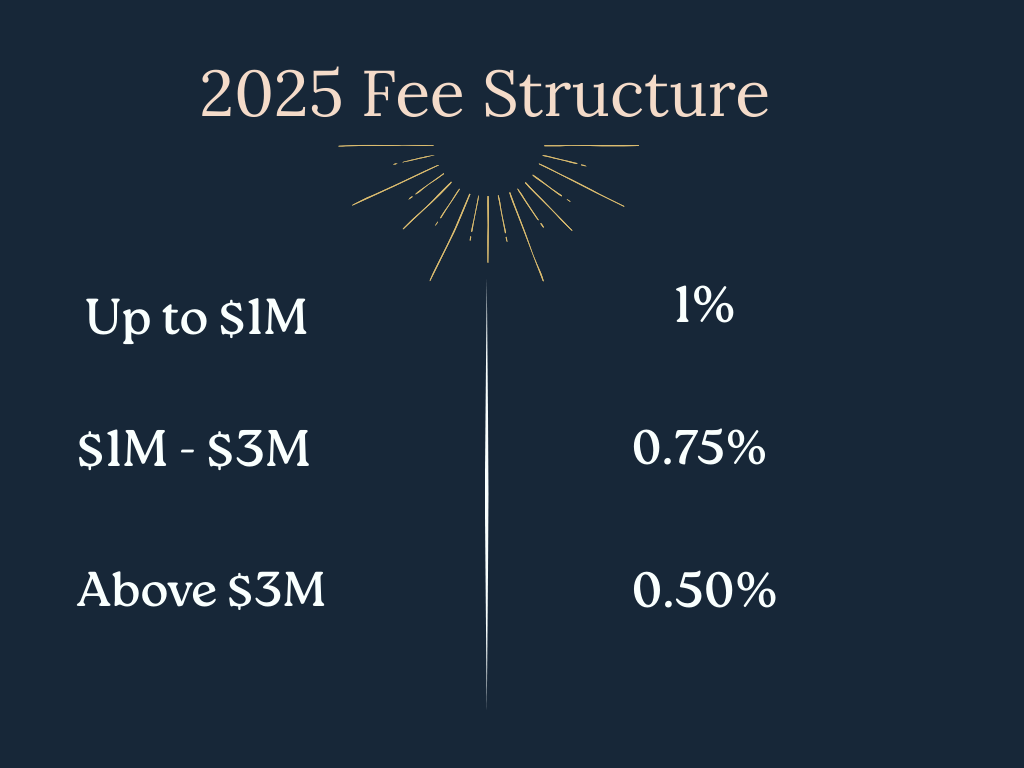

Our clients work with us on an ongoing basis, engaging us for both financial planning and investment management. We use a tiered percentage of assets under management (AUM) fee model that starts at 1.00% annually, and decreases at higher asset levels.

This structure helps keep things fair — ensuring all clients pay a consistent rate for the value they receive, with larger portfolios naturally requiring more tailored oversight.

Fees are based on an annual rate, typically starting at 1.00%

Deducted quarterly at one-quarter of the annual rate (e.g. 0.25% per quarter for a 1.00% annual fee)

Fees are withdrawn directly from the investment accounts we manage

Your full fee details are always visible in your quarterly reports through your Private Client Portal

How it Works

Tax-Efficient Fee Payment from IRAs

The TCJA Removed the ability to deduct financial advisory fees as a line-item expense on your personal income taxes, but there’s still a way to get tax breaks to get the help you’re looking for.

In some cases, clients can pay advisory fees directly from a tax-deferred account — such as a traditional IRA — for the portion of assets we manage inside that account. This allows the fee to be paid with pre-tax dollars, which may reduce your taxable income. Investors who own an IRA can choose to pay a proportional amount of their financial planning or investment management fess directly out of the account being managed. Since the fees are considered investment expenses, they are paid on a pre-tax basis. This means some investors can avoid paying income tax, something they can’t do if they pay the fees from their post-tax income.

Here’s what to know:

Fees must be paid proportionally to the assets in that account vs taxable accounts.

We’ll help ensure that fees are deducted in a way that is tax-aware and compliant.